Introducing PledgeCheck: A New Standard for Collateral Integrity

Today, most lenders still rely on borrower attestations and manual reviews to confirm ownership — processes too fragmented to catch errors or double pledging. PledgeCheck replaces that with automated, independent certification that ensures every asset in a collateral pool is unique and accurately reported. Borrowers gain faster access to capital and stronger lender confidence, while capital providers get real-time proof of collateral integrity before every funding.

Building Lender Confidence Across Every Syndicated Facility

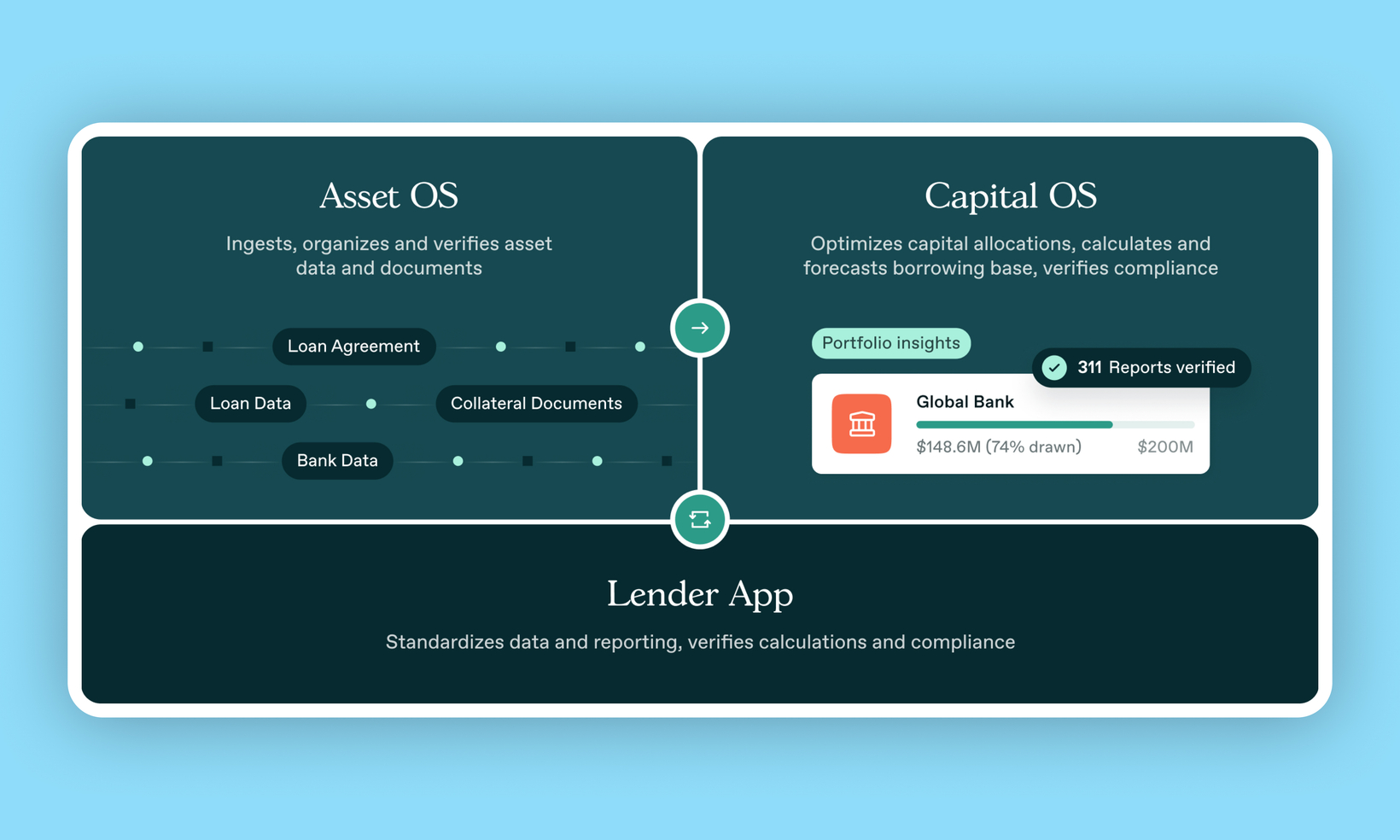

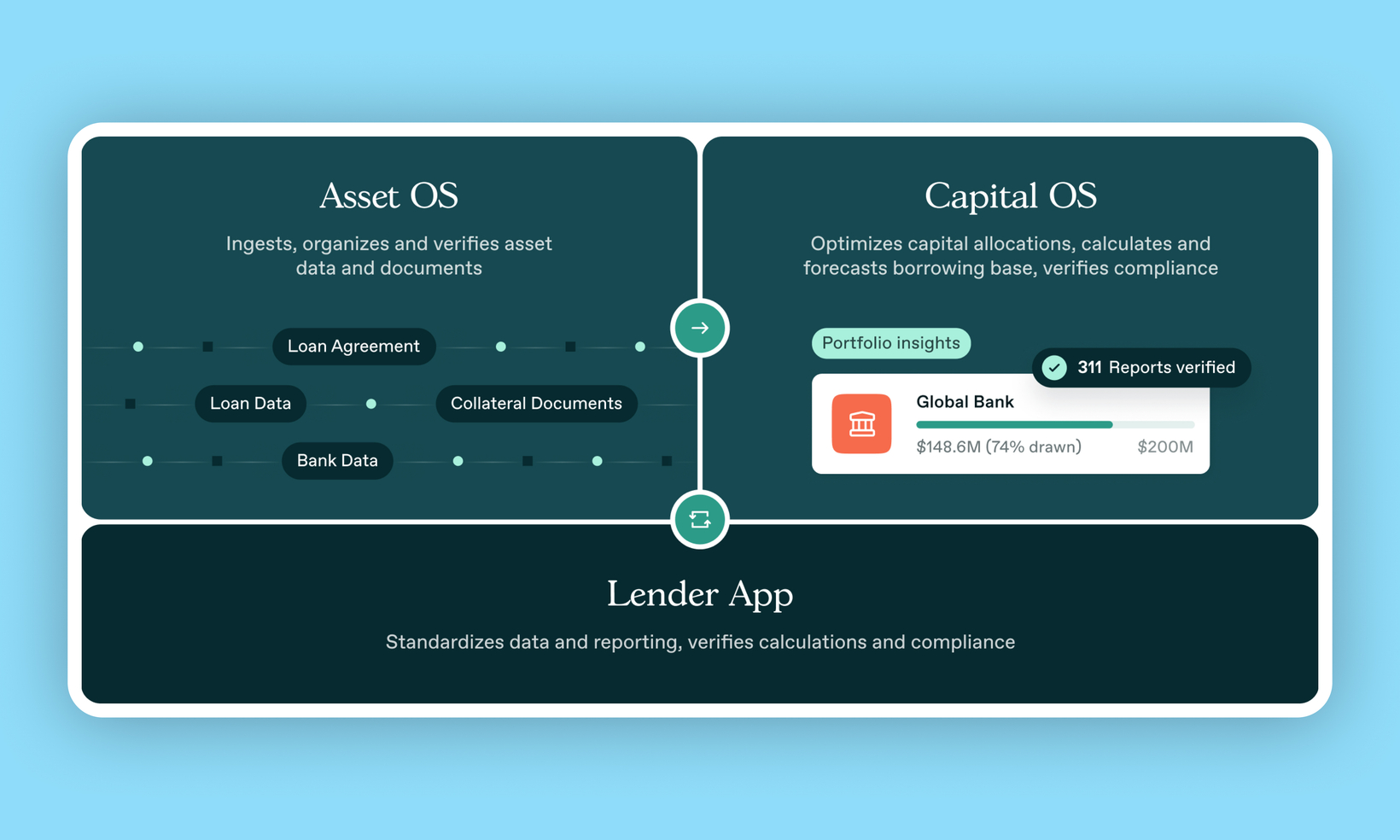

Syndicated credit facilities are designed to distribute risk—not create it. But for those managing them, the reality is often the opposite: more participants, higher expectations, and operational workflows that haven’t kept up. Borrowers turn to multi-lender structures to access more capital, optimize advance rates, or balance risk—but the operational burden that follows can quickly become a full-time job. Setpoint’s facility management technology replaces fragmented workflows with a shared operating layer, where every party sees exactly what they need, when they need it—ensuring consistency, accuracy, and trust.

Stop Wrestling with Data Tapes: Introducing Setpoint’s Data Standardization Suite

Every lender and borrower in asset-backed finance knows the pain of data chaos. Borrowers juggle different data tape formats for each lender, painstakingly mapping and cleaning data to meet credit agreement terms. Lenders validate, aggregate and normalize data across borrower facilities and funds to get a clear view of portfolio performance.

It’s slow, manual, and error-prone.

At Setpoint, we’ve seen firsthand how data friction delays funding decisions, increases operational overhead, and introduces unnecessary risk. So we built something better.

Introducing Setpoint Analytics: Turn Complex Portfolio Data into Actionable Intelligence

Loan portfolios hold valuable data, but many borrowers and capital providers struggle to extract meaningful insights. Traditional reporting tools are often manual and disconnected, making timely, data-driven decisions difficult.

That’s why we’re excited to announce Setpoint Analytics—a solution designed to unlock the full potential of your loan portfolio. Built on Capital OS, Setpoint Analytics delivers real-time insights through interactive dashboards and custom reports. Whether you're optimizing performance, managing risk, or uncovering growth opportunities, Setpoint Analytics provides a unified, easy-to-use platform for smarter, more confident decisions.

Accelerate Capital Deployment with Setpoint's Automated Borrower Approval Workflow

Managing multiple customers and diverse deals across various asset classes is a complex task for lenders. Traditionally, this can involve entire teams meticulously understanding each deal's intricacies and manually auditing borrowing base reports. This "stare and compare" approach requires sifting through numerous Excel spreadsheets and navigating a maze of email chains to ensure every borrower-provided report aligns with credit agreements.

Funding in a Fraction of the Time with Setpoint's Calculation & Paying Agent

Say goodbye to complex Excel spreadsheets and endless email chains. Setpoint's Calculation & Paying Agent Services streamline the funding process for borrowers and lenders, offering real-time verification and transparent reporting. Our platform ensures accurate data, reduces manual errors and missed emails, and speeds up approvals, transforming how you manage funding operations.

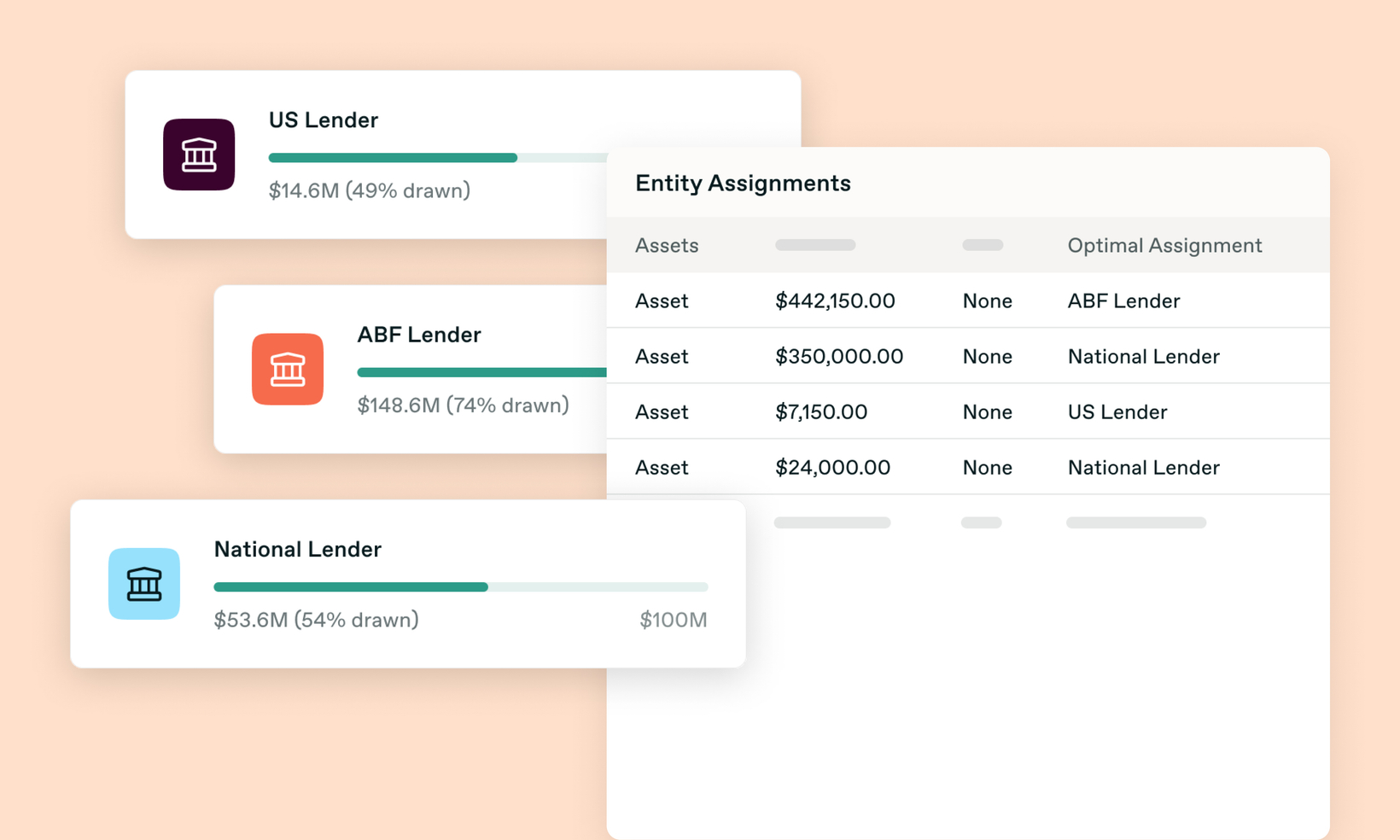

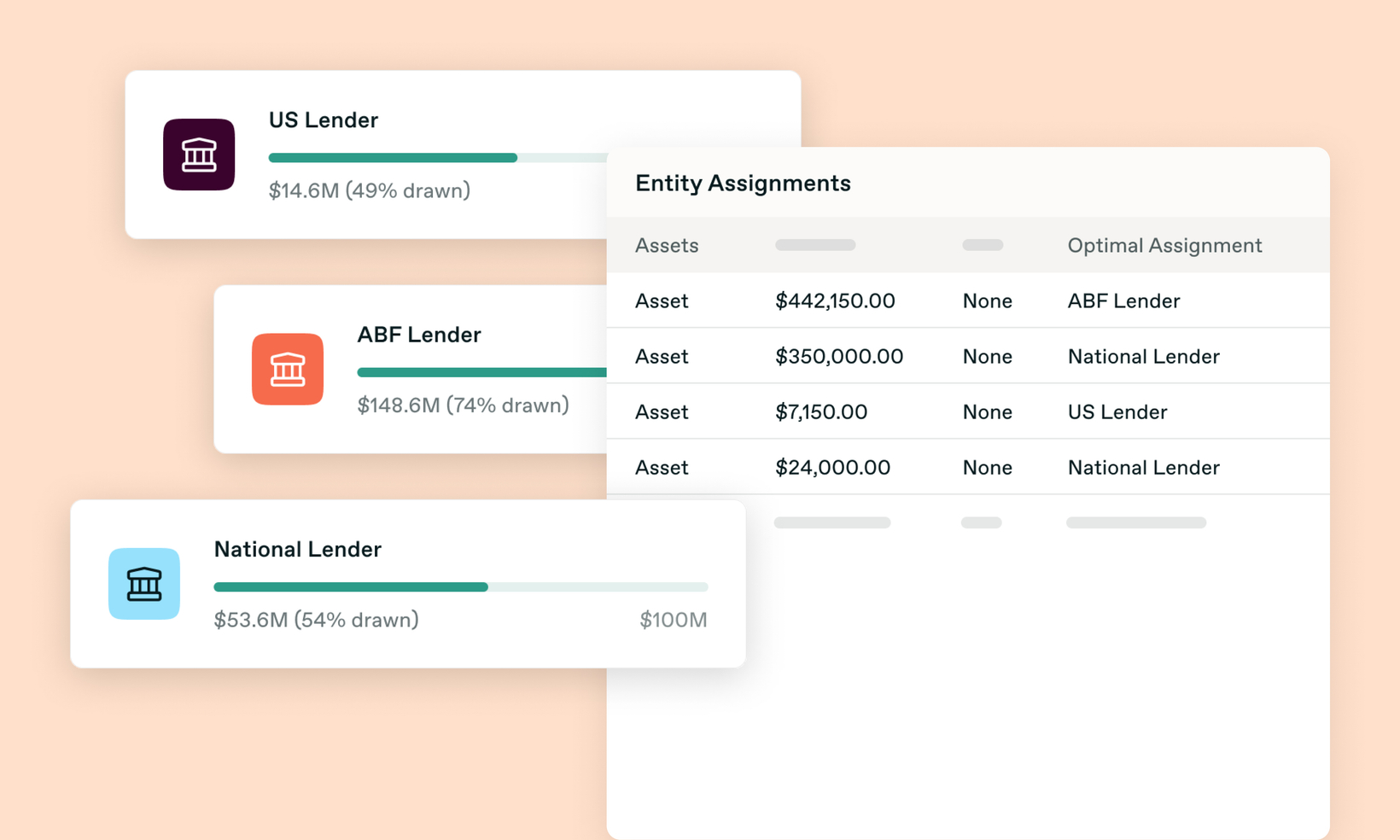

Setpoint’s Proprietary Asset Allocation & Portfolio Optimization AI Engine

The Challenge Asset allocation decisions play an important role in capital efficiency and compliance. Most capital markets teams use Excel to allocate assets...

Streamlining Capital Markets Data Management: Setpoint’s Integration Solutions

The Challenge Capital markets teams need accurate collateral and performance data. Most teams push and pull data between internal systems, CRMs, LOSs and...