- DATE:

- AUTHOR:

- The Setpoint team

Setpoint’s Proprietary Asset Allocation & Portfolio Optimization AI Engine

The Challenge

Asset allocation decisions play an important role in capital efficiency and compliance. Most capital markets teams use Excel to allocate assets between multiple warehouse lines or sources of funds. Re-assignment decisions are made ad-hoc. This manual process often fails to produce the most efficient asset allocation and exposes originators to compliance risk.

The Solution

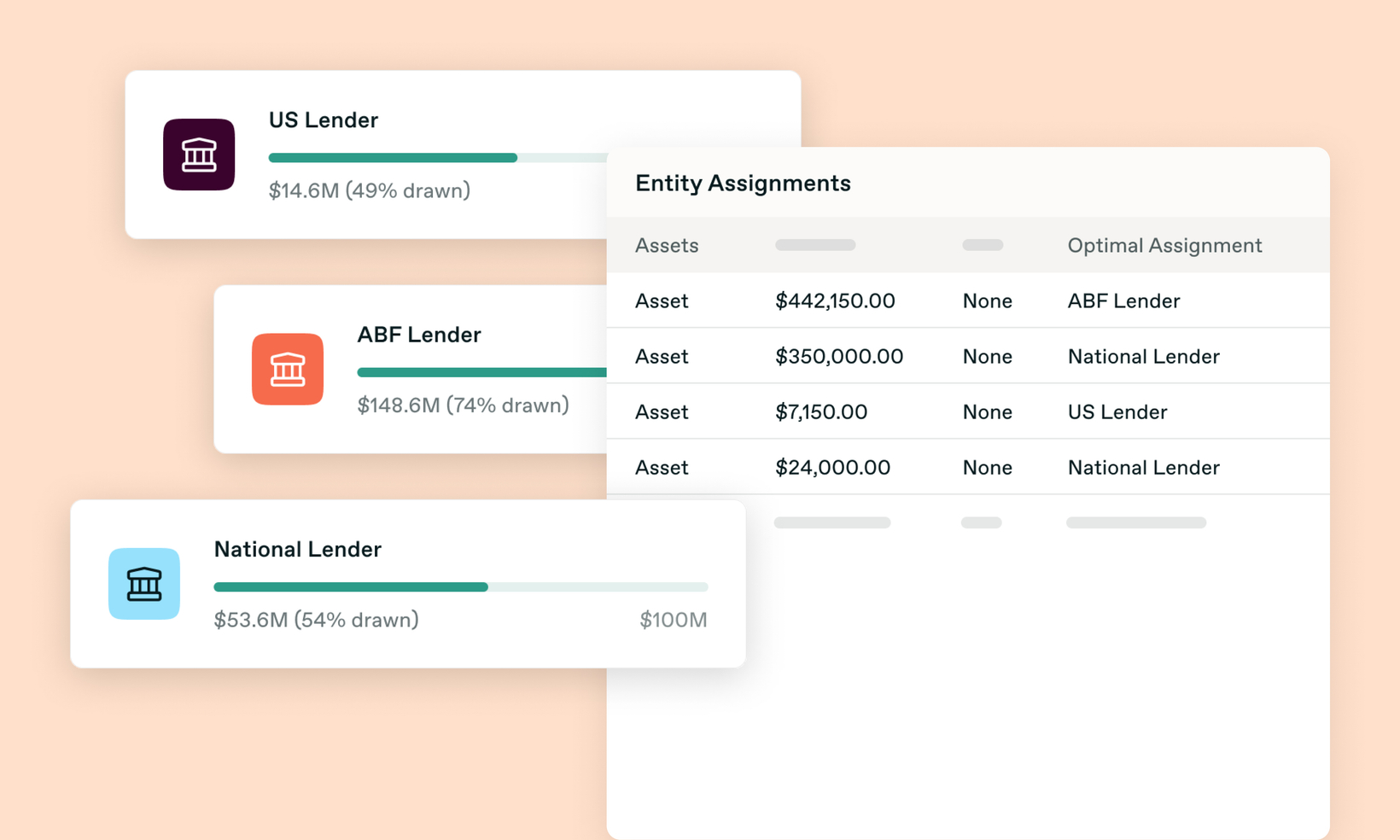

Setpoint’s Asset Allocation engine recommends an optimal, compliant asset assignment. Optimization variables are configurable and often include leverage ratio or the cost of capital. Originators can easily manage each allocation decision – initial assignment, re-allocation or securitization pool selection. Setpoint’s full suite of Capital OS features enables compliance and return forecasting on actual and hypothetical borrowing bases.

How it Works

Setpoint’s Data Science team has purpose-built a proprietary portfolio optimization model for asset-backed lending that utilizes the Genetic Algorithm computational technique.

Optimal asset allocation functionality is developed on top of core Capital OS infrastructure. Here’s how it works: